Contents:

You’ll find everything you need to know, even if you’ve never traded before, and gain confidence quickly. To summarize our Questrade review, here are some pros and cons that can help you decide if Questrade is right for you. Daniel Teo is a personal finance expert and travel writer based in Toronto. With a passion for financial literacy and a wanderlust that has brought him to over 30 countries, his stories touch on what’s possible when you achieve financial goals.

I’ve also reviewed many of the top trading platforms in Canada. Discount online broker, they still offer some of the lowest fees in the market. The best stock trading app for beginners is easy to use and offers free trades. Stacie Hurst is an editor at Finder, specializing in a wide range of topics including stock trading, money transfers, loans, banking products, online shopping and streaming. She has a Bachelor of Arts in Psychology and Writing, and she completed one year of law school in the United States before deciding to pursue a career in the publishing industry. When not working, Stacie can usually be found watching K-dramas or playing games with her friends and family.

I think in the interest of transparency you should disclose that Questrade is paying your a commission for every account that signs up on your link. You mention using them for many years, do you not agree they’re the best then? I’m a long-time user as well because I do believe they’re the best brokerage. Also, Canadian traders are clearly disadvantaged against US traders as they don’t have to think twice about making a trade or not.

Questrade ETF Fees

Disnat allows the purchase of F class mutual funds, the same list as Questrade. If you trade mutual funds and do 500 trades per year , you could save $5,000 per year with Disnat. Note that firms like Scotiabank iTrade also allow purchasing F class mutual funds (as of mid-2022). However, they also started charging $9.99 per trade as of mid-2022. It may be best for just TFSA investment but not good for active traders ..IQ edge platform is not efficient as thinkorswim..I wouldn’t not recommend for option traders .. I am not sure when Canadian brokers would allow zero commission as US did.

- So, these types of fees are something you need to consider if you’re a high volume trader.

- It’s also rated one of the top trading platforms in Canada, so you know you’re in good hands when you start your investment journey with Questrade.

- Once you have contributed the maximum amount to your RRSP and TFSA accounts, and (if you’ve got children) the Questrade Family RESP is on autopilot, your next step becomes a good news – bad news situation.

- I would recommend that investors carefully evaluate their investment goals and needs, and consider multiple options before selecting a trading platform.

You can set up a target trade, and when it is triggered, you will get notifications with charts and a description of what happened. Be aware that there will be a foreign exchange fee for converting Canadian dollars into whatever currency is needed. I give Questrade top marks in most of these categories, which is why I scored the company so high. Please note, we may receive affiliate compensation for some of the links below at no additional cost to you.

Discover Investment Opportunities

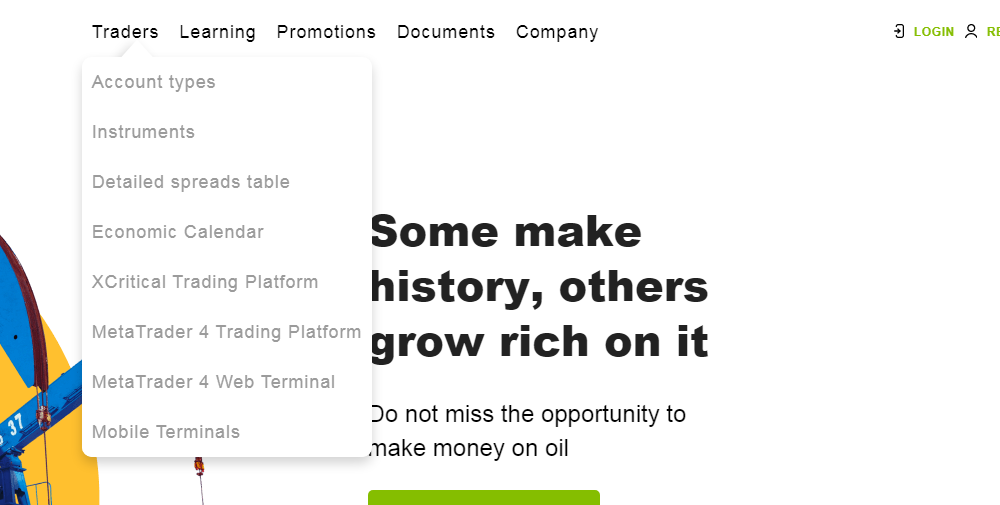

In order to truly see all the features the platform offers, you really just have to download it and play around with it yourself. I’m sure even after 10 years, I missed out on some features I haven’t uncovered. What I like to call a traders paradise, Questrade’s IQ Edge platform has absolutely everything you need to trade the markets. In terms of fees, Questrade is fully transparent about everything that they do charge.

If you are ready to get started, Questrade is also the fastest to get going and you can do it all digitally without all the hoops you would have at the banks. It’s a legit platform started 21 years ago, fully insured like the banks, and with over $25B in asset under management. You can only get 15-minutes delayed quotes for free and cannot make any transactions.

It’s important to understand that trading CFDs is extremely risky and investors can lose money quickly due to the use of leverage. An estimated two-thirds of retail accounts lose money trading CFDs. It also has a pre-installed option trading layout, and IQ Edge gives you the ability to make advanced trading orders, such as conditional orders and multi-leg options strategies. IQ Edge is highly customizable and created for advanced day traders . Questrade allows you to purchase Initial Public Offerings for FREE with a minimum purchase of $5,000.

QuestMortgage – Questrade’s BetterRate Mortgage Provider

As an experienced money manager, I believe that Questrade offers a strong trading platform for Canadian investors. Its commission-free ETF trading and access to a range of investment products make it a standout option, while its robust trading tools and mobile app offer a variety of options for more advanced investors. Questrade offers a range of features that make it a popular choice among Canadian investors. One of its standout features is commission-free trading for ETFs, which can save investors a significant amount of money over time. Additionally, Questrade offers access to a wide range of investment products, including stocks, bonds, mutual funds, and options.

How To Buy ETF In Canada: Free Guide To Select The Best ETF In … – Biz Report

How To Buy ETF In Canada: Free Guide To Select The Best ETF In ….

Posted: Sun, 25 Dec 2022 08:00:00 GMT [source]

For a complete breakdown of how we score each category, read the full methodology of how we rate trading platforms. Get verified (usually takes 1-2 business days) and load funds into your account to start trading. View the latest stock data to make the most of your investments.

Questrade Fee Summary:

The nature of leverage means that they are high-risk investments with the potential to lose money quickly. Trading in Canadian and US Dollars, with no unnecessary Questrade currency conversion fee when you buy US stocks. There are plenty of hidden fees that you end up paying and no way whatsoever to track them. Whoever wrote this article needs to actually open an account and try interacting with Questrade. Similarly, you can enter a security name or symbol and scan results by financials, valuation, filings or other key metrics. The difference between each portfolio is the ratio between higher-risk investments, such as Canadian, US and international equity ETFs, and lower-risk fixed-income ETFs, such as bonds and GICs.

Top 8 Best Trading Platform In Canada For 2023 – Investing – Biz Report

Top 8 Best Trading Platform In Canada For 2023 – Investing.

Posted: Sat, 24 Dec 2022 08:00:00 GMT [source]

While you can enjoy access to many portfolio management tools, you may need to pay an account maintenance fee . Qtrade offers many comprehensive tools to help you manage your investment portfolio. The Qtrade tools allow you to invest with confidence after taking appropriate risk-management efforts. Is it safe to invest in Questrade and use the services on online platforms?

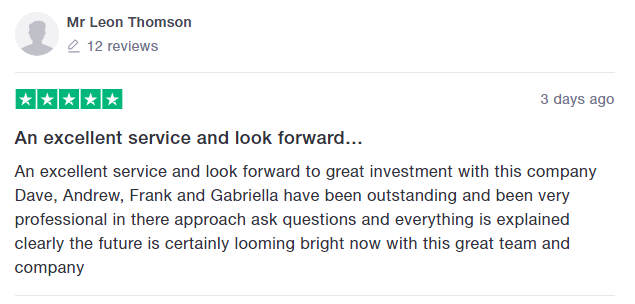

They had my account frozen for no good…

When you login first time using a Social Login button, we collect your account public profile information shared by Social Login provider, based on your privacy settings. We also get your email address to automatically create an account for you in our website. Once your account is created, you’ll be logged-in to this account. In the interest of full disclosure in regards to how safe Questrade is, the company announced in 2022 that CWB Trust Services would now handle the registered plans for Questrade as their official trustee. It does offer some interesting features like real-time info, an overview chart and customizable alerts.

With an individual account, you’ll get access to global markets and can trade 24 hours a day. A joint account gives you all the advantages of an individual account, plus allows you to pool investments with a group of two or three investors for a bigger stake in the market. There’s also the potential for corporate, partnership, informal and formal trusts, investment clubs, and sole proprietorship accounts. Questrade is one of the only full-service brokers that allows investors to trade forex.

- The CESG cash, plus your investment returns within the Questrade RESP account will be taxed as income in the hands of the student.

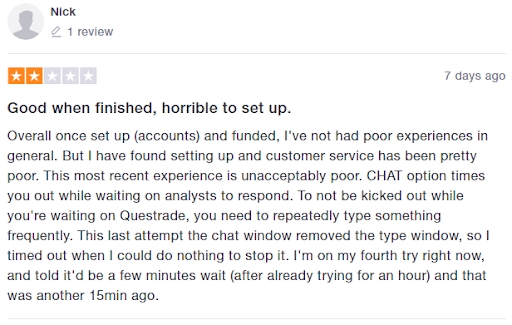

- The website’s search function is good and offers clients access to any information without going through numerous screens and options to get there.

- I agree that Questrade has a lower fee structure but unless you are a heavy trader the difference of $2-$3 per trade is minimal.

- The Weathsimple charges 1.5% on exchange rate so basically you lost money for buying and selling US stocks.

I have used both https://broker-review.org/s as well as TDW, RBC and iTrade. I agree that Questrade has a lower fee structure but unless you are a heavy trader the difference of $2-$3 per trade is minimal. Qtrade also has a list of over 100 free ETFs that can bought and sold without fees and while some are popular a lot of the choices are thematic or obscure and not suitable for most portfolios.

Although continually updated, the information here may differ from what appears on the providers’ sites. These are two of the most popular trading platforms on the market in Canada today. For example, you could transfer money from TD to Questrade using a simple interface.

The pre-fab questrade review options cater to a variety of investor types, from conservative to aggressive to socially conscious, and are rebalanced automatically to make the entire investing process super simple. Questrade offers a user-friendly platform, with a clean interface and easy-to-use tools. Investors can easily navigate the platform to place trades, set up watchlists, and track their investments.

Honestly, I can’t think of a single negative to say about Questrade’s security. And finally, lets have a look at margin interest rates to see what you’ll be paying if you decide to trade on margin. Overall, it’s highly likely the account you’ll need, whether you are an individual or a company, will be available at Questrade. But before we get into our in-depth Questrade review,lets look at some overall pros and cons.

No, they won’t cover you if you log into Questrade at your local library and leave your account open when you leave. If you decide to use a friends phone or a desktop that is not yours, you will be prompted to answer a security question to verify that it is truly you who is trying to access the account. Its live chat option is a breath of fresh air, and normally it would take me no longer than 2-3 minutes to connect to an agent to perform things like Norbert’s Gambit to get USD. Our goal at RetireHappy is to present readers with reliable financial advice and product choices that will help you achieve your financial goals. Get exclusive access to our private library of e-books, special reports, online guides and popular newsletter.