Contents:

If the close is higher than the open – the candlestick mid-section is hollow or shaded blue/green. The only difference between them is whether you’re in a downtrend or uptrend. In most cases, a dragonfly doji is usually viewed as a more accurate sign of a reversal. On the second example, we see the USD/ZAR pair in also a minor downward trend. The fourth one opened slightly below where the third one closed, fell sharply, and then closed near where it opened.

Candlestick traders will typically look to enter long positions or exit short positions during or after the confirmation candle. For those taking new long positions, a stop loss can be placed below the low of the hammer’s shadow. Doji candlesticks are a thing apart from the two mentioned above.

Bitcoin, Ethereum And Dogecoin Plunge, Moving Anti-Market: A … – Investing.com UK

Bitcoin, Ethereum And Dogecoin Plunge, Moving Anti-Market: A ….

Posted: Fri, 03 Mar 2023 23:10:00 GMT [source]

We’re also a community of traders that support each other on our daily trading journey. This means that buyers attempted to push the price up, but sellers came in and overpowered them. This is a definite bearish sign since there are no more buyers left because they’ve all been overpowered.

Morning Stars and Evening Stars Candlestick Pattern

The opening price in the marubozu is also the lowest price while the closing price is the highest price. In other words, the candle opens at its lowest price and closes at its highest price. A white marubozu signals that buyers were in control of the entire trading session. Combined with other trading methods such as fundamental analysis and other market analysis tools, the hammer candlestick pattern may provide insights into trading opportunities. This article will take you through what hammer candlestick patterns are and how to read them. The dragonfly doji, like all the other candlestick patterns, should not be used in isolation.

A https://g-markets.net/ candlestick is a strong signal, and when it appears, it is highly possible that the trend will reverse. Therefore, the hammer formation is a good reason to open long trades. In this situation, when the prices are going up then the hanging man hints that the top will be reached shortly and prices will slow down again. In this situation, when the prices are going down then the hammer hints that the bottom will be reached shortly and prices will pick up again. You must have seen simple line and bar charts but the Japanese Candlestick Char Technique is a thing on the next level. In 1710, a futures market for rice trading emerged in Japan and secondary coupon markets thrived in the Japanese cities of Sakata and Osaka.

Hammer Candlestick: What It Is and How to Spot Crypto Trend Reversals

If a Doji forms after multiple candlesticks with long-filled bodies, the Doji is trying to tell that the sellers are becoming exhausted and losing ground. For the price to continue falling, more sellers are needed but there aren’t any more left! If a Doji forms after multiple candlesticks with long hollow bodies, the Doji is trying to tell that the buyers are becoming exhausted and losing ground. For the price to continue climbing, more buyers are needed but there aren’t any more left!

In contrast, an Evening star Doji identifies an upcoming downtrend. The third is a long bullish candlestick, gaping higher than the previous candlestick. A Morning Star Doji is used by stock analysts to predict price movements of a security, derivative or currency over time.

Single Candlestick Chart Patterns

Generally speaking, when such a pattern forms after a pullback, a bullish reversal is likely. Indeed, the very shape of this bar implies the market has moved from a net-selling environment to a net-buying environment. Although no trader has a perfect crystal ball, there are certain chart shapes and cues that are reliable indications of what’s apt to happen next. One of the more reliable, and more comment, patterns any trader should recognize is the so-called hammer pattern… When these types of candlesticks appear on a chart, they cansignal potential market reversals. Hammer candlestick patterns are not very reliable by themselves.

This confirmation candle should ideally reflect significant purchasing. During or after the confirmation candle, candlestick traders will generally attempt to acquire long positions or exit short positions. If you’ve spotted a hammer candlestick on a price chart, you may be eager to make a trade and profit from the potential upcoming price movement.

Stay on top of upcoming market-moving events with our customisable economic calendar. What does the Marubozu Candlestick Pattern on the chart warn about? What is the meaning of the Marubozu in Forex and other markets?

- A declining candle is defined as one that closes lower than the previous candle’s closing.

- Any research provided should be considered as promotional and was prepared in accordance with CFTC 1.71 and designed to promote the independence of investment research.

- It looks just like a regular inverted hammer, but it indicates a potential bearish reversal rather than a bullish one.

- Candlestick charts are great for providing decision support to technical indicators and chart patterns.

As shown below, the dragonfly doji has a similar appearance to the hammer pattern or capital letter T. While hammers still show you some clear intention – buyers and sellers are fighting, but you can still foresee who will win, Dojis show extreme uncertainty. Since hammers are mainly found at the end of trends and waves, many traders use strategies that involve these zones to choose entry and exit points.

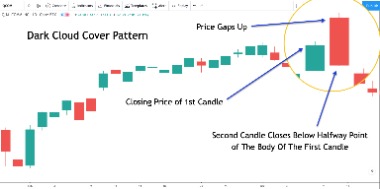

Reversal is confirmed if a subsequent candle closes in the bottom half of the initial, long candlestick body. The Piercing Line is the opposite of the Dark Cloud pattern and is a reversal signal if it appears after a down-trend. A Dark Cloud pattern encountered after an up-trend is a reversal signal, warning of «rainy days» ahead. The shadow is the portion of the trading range outside of the body. We often refer to a candlestick as having a tall shadow or a long tail.

You will improve your candlestick analysis skills and be able to apply them in trading. As the name suggests, the Morning Star and the evening star patterns are found at the end of the ongoing trend. The evening one signals the end of the trend, the way evening signals the end of a day. On the other hand, a morning star signals a fresh beginning like a real morning which hints at the start of a new day. The ultimate result of Doji candlesticks means neither buyers nor sellers are able to gain control and a struggle is ongoing between them.

The hammer doji candlestick occurs when sellers enter the market during a price decline. By the time of market close, buyers absorb selling pressure and push the market price near the opening price. The hammer candlestick is used to determine a trend reversal in the market.

TRX Price Analysis: Is TRX trending under a parallel channel? – The Coin Republic

TRX Price Analysis: Is TRX trending under a parallel channel?.

Posted: Sat, 04 Mar 2023 20:00:00 GMT [source]

Some traders will treat any hammer with a narrow body as a doji. The position of the body is usually more important than the body size itself or its color. QuantFactory helps traders elevate their trading game with access to valuable resources, knowledge and expertise in quantitative finance.

Their appearance on the price chart signals the beginning of a new bullish trend. A doji is another type of candlestick with a small real body. A doji signifies indecision because it is has both an upper and a lower shadow.