Additionally, you should compare your budget with the cost of maintaining a full-time accounting team and the required technology stack. It’ll not only help you see the cost advantages of outsourcing but also prevent you from overspending. Firstly, you can concentrate on other important functions when you have the assurance of an expert team handling your finances.

Want More Helpful Articles About Running a Business?

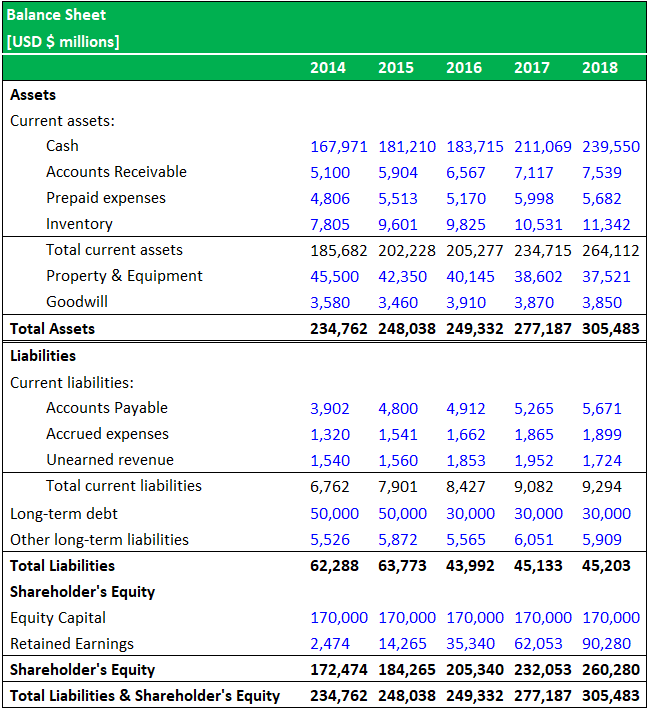

Ignite Spot Accounting delivers heftier reports than many other cloud accounting providers we checked out for this piece. Along with typical financial reporting (like profit and loss reports and balance sheets), you’ll get a KPI (key performance indicator) report and profitability analysis, among others. You have to enter more information about your needs to get a quote—which is useful if you want truly customized services but unhelpful if you’d rather choose a basic plan out of a lineup. To learn more about LBMC’s outsourced accounting services, contact an advisor today.

- Many businesses work with an outsourced CFO on a short-term project basis, although longer-term, ongoing advisory relationships are also common.

- AI tools will save you time when it comes to boring accounting admin tasks, such as combing through data for insights, scheduling meetings with clients, or even generating reports.

- Are you looking for complete financial service outsourcing, or do you need to outsource specific tasks?

- We offer a suite of services that leverage leading technology platforms tailored to your own unique needs.

Continuously evaluate the partnership

Reap the benefits of big-business infrastructure and proven best-practices without all the usual hassle and expenditure. You should also specify what happens if the provider fails to meet any of these expectations. This could be anything from a partial refund for a late delivery, to termination of the contract in more extreme cases. Once you’ve https://www.business-accounting.net/ established what you want to outsource, the next next step is to identify who you’re going to outsource it to. If you’d like to outsource some or all of your accounting obligations, here’s how to get started. As well as helping you comply with all relevant laws, this ensures that you are fully prepared if your company gets audited.

Accounting Outsourcing: How to Hand off Your Financial Tasks (With Recommendations)

Outsourced CFO services are much more advisory in nature than outsourced bookkeeping or controller services. Additionally, when you outsource bookkeeping, you lose the ability to walk over to your bookkeeper’s desk and ask them a quick question. However, provided your outsourced bookkeeping partner embraces cloud-based accounting software, you’ll have access to your books 24/7. In doing that, your outsourced accounting firm will work closely with you to develop an approach that works for your business. They’ll track KPIs that are important to you, provide regular financial reporting, and be responsive to your needs when you call with questions.

Business continuity

Regardless of industry or rate of growth, companies can find value in hiring an external firm to handle accounting services and improve financial reporting. If you’re curious about what that process looks like, you’ve come to the right place. In this comprehensive guide, we’re exploring every element of outsourced accounting. We’ll share the types of tasks that can be outsourced and highlight the key issues business owners need to consider when assessing outsourcing accounting providers. If your company has never utilized outsourcing as a resource before, you may have some questions that give you pause. Better yet, you may wonder why you should outsource your finance tasks rather than taking the traditional in-house approach.

Accounting outsourcing services designed for US accounting firms

Many companies outsource this task to experienced auditors, who can independently assess your company’s financial processes and even advise on ways to improve. When you outsource, you can leverage the expertise and experience of firms who are already established in those markets. This ensures that your tax and legal obligations are being handled by local accountants who understand local tax laws and regulations, and who are sufficiently qualified. With all accounting software and data hosted on the cloud, an accountant can access everything they need by simply typing their password in a browser anywhere in the world. They can work from home, in the office, or while visiting their grandparents in Arizona.

From transformational accounting practices spearheaded by blockchain, to new ways of working in the wake of the pandemic, accountancy is going to see some serious upheaval in 2024 and beyond. If your accounting is not yet done in the cloud, you may want to consider it as an option. Change can be hard, so if you choose to upgrade, consider consolidating https://www.business-accounting.net/professional-bookkeeper-america-s-1-bookkeeper/ some of the work by outsourcing and upgrading to the cloud in one go. Additionally, relying on outside help will allow you to attract talent that might not be available locally. As businesses embrace outsourcing, they position themselves for sustainability, competitive advantage, and long-term success in an ever-evolving marketplace.

Your accounting team can provide you with important insights into your finances and help your company grow by assisting you as you make critical decisions. An external accountant will provide you with accurate and detailed financial reports, ensuring you stay competitive as your business grows. Ongoing support is also offered for changing compliance and regulatory standards to ensure your business is informed and compliant, minimizing the risk of financial discrepancies. Above all, outsourced accounting is intended to provide a holistic approach to managing a company’s financial affairs, so leadership and staff are free to focus on key operations. Outsourcing can provide several benefits, including cost and time savings, as you will no longer need to oversee the hiring and training of in-house accounting employees. This allows businesses to redirect internal staff and resources to support higher-value, core business operations and boost productivity.

It also starts at $190 a month, which is less than nearly every other provider on our list. Smaller businesses might get by with a basic Quickbooks set-up, but once you start growing, building a more sophisticated financial infrastructure is vital. Staffing an internal finance and accounting team is expensive and can place significant demands on your time. If you think you can get by without any accounting function, you’re in for a whirlwind of a surprise (and not in a good way). When taking a look at your team members’ responsibilities, you probably know that a majority of their job involves spending copious amount of time on low-impact tasks.

Improve efficiency of P2P processes, create smart functions that find, connect and analyze data to uncover deeper insights and inform intelligent decisions. To discuss outsourcing your finance and accounting, as well as our customizable solutions, request a demo today. If errors reporting and analyzing current liabilities in your books keep appearing, that means the person taking care of your books is not doing the right job. By outsourcing these services, you can take advantage of the multiple layers of review built into your provider’s processes, which allows them to detect most errors on time.

And although those tasks are necessary (like closing the books), they also take away the focus from furthering the growth of your company. In fact, research shows that the more disengaged an employee is, the less productive they become. Check your providers’ reputation by looking at client testimonials and reviews. Take a look at their testimonials of clients that the outsourcing service provider has worked for in the past.

However, this can be mitigated significantly by choosing the right accounting partner and building a positive relationship. Also, take all relevant steps to protect sensitive financial and employee information during data transfers. This will help minimize the potential for data misuse, keep your data secure, and ensure you’re compliant with any relevant data protection laws in your region. Directly engage with potential providers and request a meeting to discuss your needs. Compare your options and choose a provider that meets your requirements and, of course, your budget.

E-signature and file sharing services can also help more employees operate from the cloud. If you feel now is the best time to start outsourcing your accounting department, you have a choice of firms that specialize in it. Although you may lose some control, you can devise ways to mitigate that while increasing your business’s efficiency. The ultimate goal is to free up time and allow yourself to focus on the core function of your business. When outsourcing finance and accounting, robust security measures to protect sensitive financial data are a must.

Outsourcing some or all of your accounting needs to an external third party can represent a major win for business owners. At LBMC, our mission is to support entrepreneurial businesses at every stage to go further. Building a robust accounting infrastructure is a foundational element of that. That’s why our outsourced accounting services are set up to provide firms with the exact level of support they need. No one knows the challenges of managing your company’s finances better than you.

However, we’re here to tell you that not only can all companies benefit from outsourcing, small- to mid-sized organizations might just have the most to gain. In this comprehensive guide, we’ll walk you through every step of the outsourced accounting process, from initial setup to ongoing management. While they were traditionally in-house functions, an increasing number of businesses today outsource their finance and accounting operations to third-party services providers. To combat this growing problem, the accounting industry has increasingly focused on its own data security in recent years. Accounting firms have likely worked with many businesses like yours and have seen it all, including the successes as well as the mistakes that other companies have made.